While three quarters say they understand it well, the number who can correctly interpret news on inflation is significantly lower

Last week, the ONS announced that inflation had fallen to 3.2% in March, the lowest it had been since September 2021, although this represented a slightly smaller drop than had been predicted.

The cost of living crisis has been the dominant issue in the UK for more than a year – so much so that Rishi Sunak made a promise to half inflation as one of his ‘five pledges’ at the beginning of 2023 (a task that only 27% of Britons think he is performing well at).

But how well do Britons grasp the concept of inflation in the first place?

If you ask them directly, 77% of Britons say they understand what inflation is well, including 20% who say they understand it “very well”. A further 17% say they don’t understand it very well, and 4% say they don’t understand it at all.

However, when we then put their knowledge to the test, many Britons come up short. When told that the rate of inflation had fallen to 3.2% in March, only 52% of Britons correctly identify that this means that prices are rising more slowly than they were before March.

Three in ten Britons think this means that prices are falling, including 18% who believe it means that they are falling faster than before March and 13% who think it means they are falling more slowly. A further 4% think it means that prices are rising faster than they were before March, while 13% told us they didn’t know in the first place.

Of those who told us they understand what inflation was “very well” or “fairly well”, fully 40% either got the answer wrong or said they didn’t know.

Voters who backed Labour in 2019 are more likely to give the correct definition of inflation (62%) than their Conservative-voting counterparts (50%). Those in middle class households are also more likely to give the right answer (58%, compared to 44% in working class households), as are men when compared to women (59% vs 46%).

Perhaps unsurprisingly, younger Britons are less likely to correctly define inflation than their elders; 44% of 18-24 year olds compared to 52-54% in older age groups.

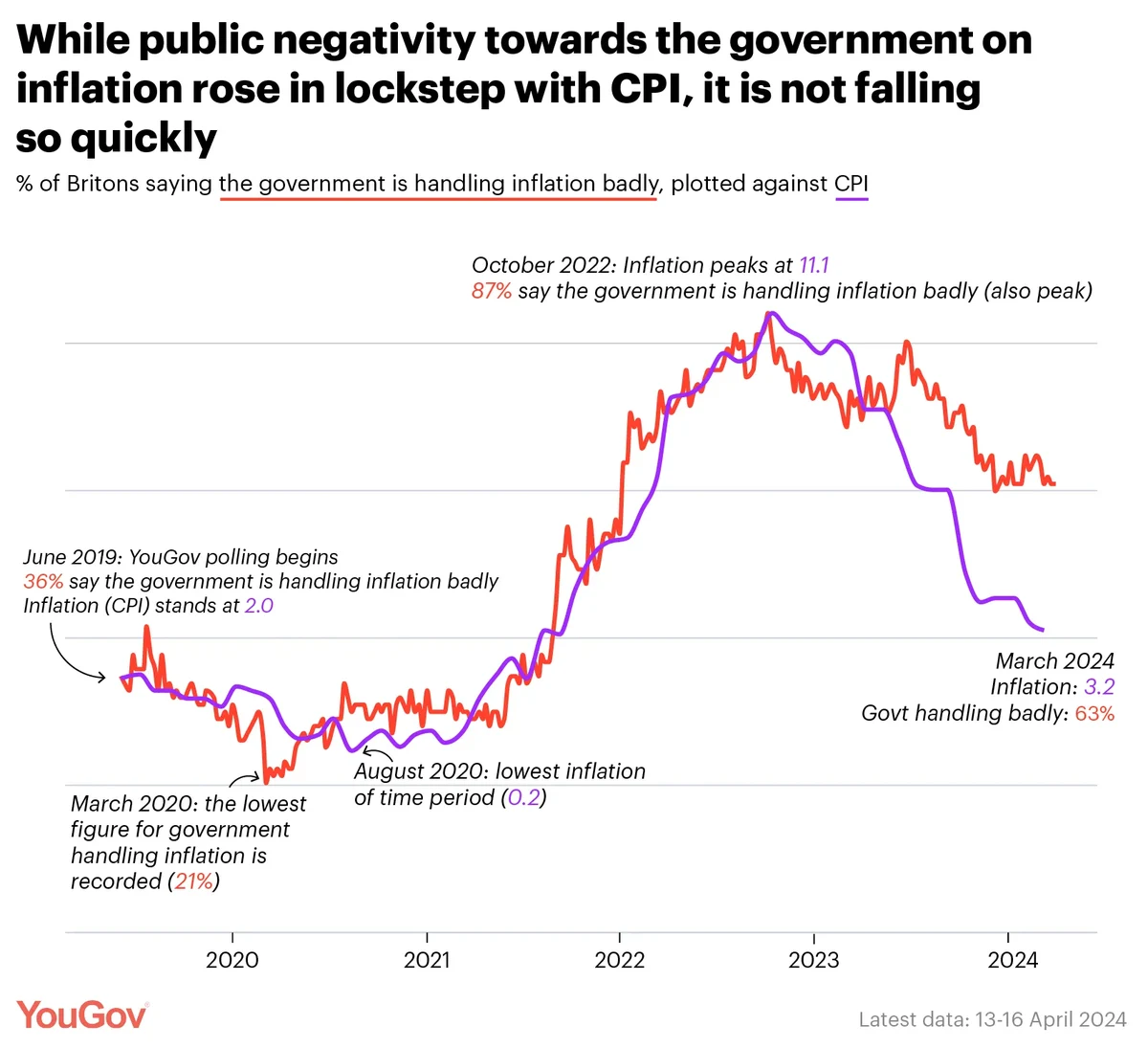

While negativity towards the government’s handling of inflation if receding, it lags behind the speed at which inflation is dropping

Our website tracker data shows that 63% of Britons think that the government is handling inflation badly, compared to 28% who think it is handling it well.

If we compare attitudes towards the government’s handling of inflation with the rate of CPI over the same period, we can clearly see that public opinion closely mirrored the rate of inflation as prices rose. However, while negative perceptions of the government’s performance are falling, they are not falling as quickly as the rate of inflation.

An obvious point here is that falling inflation is not the same as falling prices – while inflation may be falling, prices remain high, which means a lag in attitudes is to be expected as Britons continue to struggle with their household budgets. (Other factors will also be playing a role, not least the significant unpopularity of the government more broadly.)

What this is means is that government success in tackling inflation probably won’t pay immediate electoral dividends – and with a general election required in coming months, the government does not have the luxury of being able to wait to take credit.

What do you think of inflation, the government's handling of the cost of living crisis, and everything else? Have your say, join the YouGov panel, and get paid to share your thoughts. Sign up here.

Photo: Getty